No one wants to buy gold or gold stocks when it looks like they’re tumbling. I get it.

For intelligent investors, the fear of loss is a greater motivator than the anticipation of gains. Most investors actually prefer to make the boldest moves when the market seems like it won’t ever go down.

That’s why bull markets tend to entrap people to buy at the top and sell at the bottom: people seek validation and want to participate with the herd…

But we’re nowhere near the end of this gold market and I can prove it with a few basic charts.

For one, bull markets tend to end when the masses come, and we aren’t there yet.

Take a look at the chart of GLD ETF’s shares outstanding below. When investments come into the GLD shares are created. When investments sell out of the GLD ETF shares are destroyed. Tracking shares outstanding measures true investor demand for the underlying asset.

GLD shares outstanding is only 356 mil, well below the 2011 peak when shares outstanding was 450 mil. This has been a large move in Gold that hasn’t been supported by massive inflows yet.

Gold will continue higher until investors pile into the GLD ETF. When GLD shares outstanding spike above 450 mil it will be time for caution. We aren’t there yet.

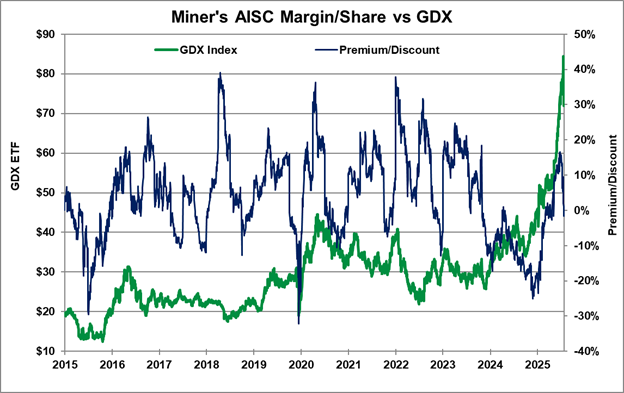

At the peak of this gold run, we will also see miners trade much closer to their actual net asset values. We’ll see the average gold stock priced for perfection, meaning the whole market will get bid up to the most extreme valuation possible…

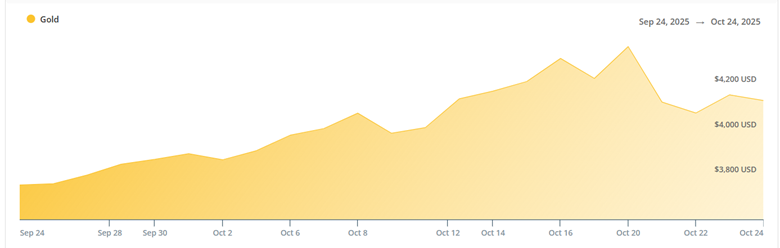

The truth is, (as I’ve been writing over the past month or so) the correction we’re in right now was due. Every technical indicator was stretched and overextended. That doesn’t mean the bull run is over, it just means the market needed to catch its breath.

When gold gives you a chance like this to buy your favorite gold companies during a mid-bull run correction, you need to pounce.

“The most obvious opportunity in

gold stocks I’ve seen in my career”

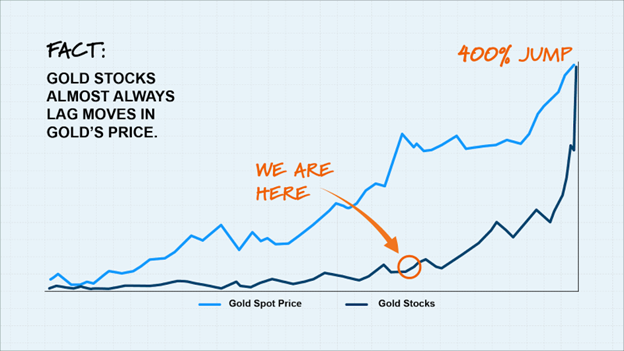

While everyone is distracted by gold’s historic bull move, gold stocks are still wildly undervalued and largely ignored by the investment public.

And 20 year veteran gold analyst Garrett Goggin has pinpointed a single gold stock that’s selling for a massive 80% discount to its value… And it’s just weeks away from opening its world class gold mine. When it does, billions of dollars of value will be obvious, and Garrett expects the stock to jump 400% in the weeks and months after…

Time is running out to get into this stock BEFORE it goes into production… Click here to get in now.

Today, the average gold stock is trading at about a 1% discount to gross profit. During peaks, that number will soar to a 30% premium.

But remember, I don’t cover the average stocks that make up the GDX. I cover the world’s best gold miners – all of which are now selling for the best price we’ve seen in a month.

It already looks like the correction could be over… the market has bounced after testing lows just over $4,000/oz.

It might be that we’ve seen the last of $4,000 gold – something that seemed like a faraway target just over a month ago.

I actually wrote (bullishly) over this summer that we “could” see $4,000 gold by the end of the year. That timeline got pushed up faster than anyone thought possible.

But all of the same pieces that gave us $4,400 gold are still in place. The thesis is intact. Congress is still infighting over who knows what while our deficits continue to grow.

It was just this past August when the Federal debt hit $37 trillion, and it was only a week ago when it surpassed $38 trillion.

The monetary trainwreck is still underway…

Don’t let this correction pass without making the intelligent move to buy more gold stocks. I promise: it won’t last.

Which brings me to a timely recommendation. Just this past Wednesday (when this correction was still unwinding) I released a brand new investment brief about my favorite gold stock to own today.

You can still see this brief here, for free.

If you’re looking for a simple, no-brainer gold investment to make right now, this is my highest conviction gold miner to own.

Have a good weekend,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio